The 9-Minute Rule for Personal Loans copyright

The 9-Minute Rule for Personal Loans copyright

Blog Article

Some Known Facts About Personal Loans copyright.

Table of ContentsHow Personal Loans copyright can Save You Time, Stress, and Money.8 Easy Facts About Personal Loans copyright DescribedSome Known Questions About Personal Loans copyright.Not known Details About Personal Loans copyright The Personal Loans copyright Statements

Let's dive right into what an individual car loan really is (and what it's not), the factors individuals use them, and exactly how you can cover those insane emergency costs without handling the burden of financial debt. A personal loan is a round figure of money you can obtain for. well, almost anything., however that's practically not an individual lending (Personal Loans copyright). Individual fundings are made with a real monetary institutionlike a financial institution, credit score union or on the internet lending institution.

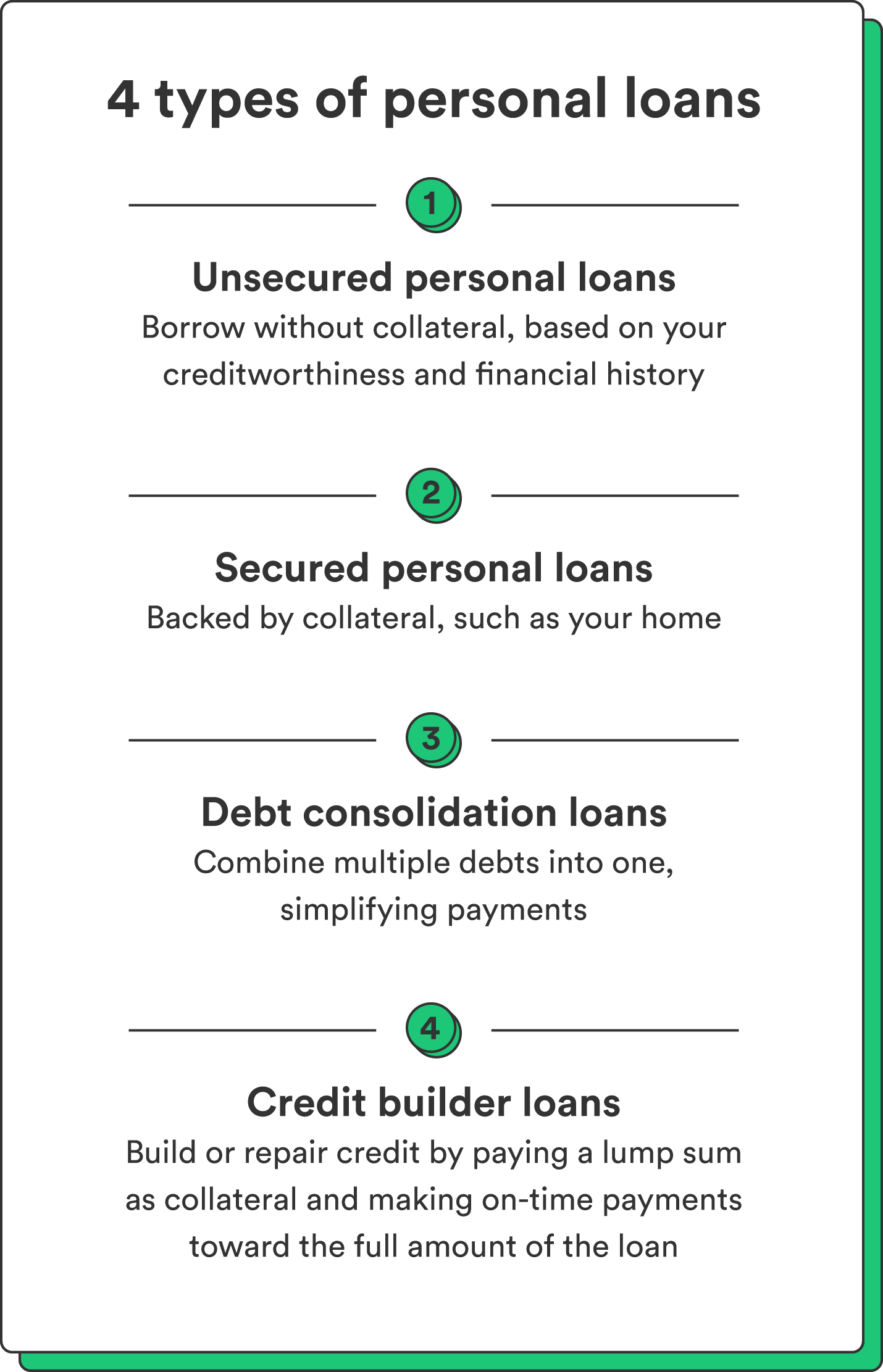

Let's take an appearance at each so you can understand specifically how they workand why you do not need one. Ever before. Many individual fundings are unsecured, which indicates there's no security (something to back the car loan, like a vehicle or residence). Unprotected loans normally have greater rate of interest prices and require a far better credit rating due to the fact that there's no physical item the loan provider can remove if you do not compensate.

See This Report on Personal Loans copyright

Surprised? That's okay. No matter how good your credit rating is, you'll still have to pay passion on most individual lendings. There's always a price to pay for borrowing money. Secured individual loans, on the various other hand, have some type of security to "safeguard" the lending, like a boat, jewelry or RVjust among others.

You can additionally get a secured individual loan utilizing your cars and truck as collateral. Yet that's a hazardous relocation! You do not want your major mode of transport to and from work obtaining repo'ed due to the fact that you're still paying for last year's kitchen area remodel. Trust us, there's absolutely nothing protected about secured loans.

Just because the repayments are predictable, it does not mean this is an excellent offer. Personal Loans copyright. Like we claimed previously, you're quite a lot assured to pay passion on an individual finance. Just do the math: You'll finish up paying means more in the future by getting a lending than if you 'd simply paid with cash money

The 7-Minute Rule for Personal Loans copyright

And you're the fish holding on a line. An installment funding is an individual loan you pay back in taken care of installations over time (typically when a month) up until it's paid in complete - Personal Loans copyright. And do not go to my blog miss this: You need to repay the initial financing amount prior to you can borrow anything else

Don't be mistaken: This isn't the very same as a credit score card. With line of credits, you're paying interest click here for more info on the loaneven if you pay on schedule. This type of finance is incredibly complicated due to the fact that it makes you assume you're handling your financial debt, when truly, it's managing you. Payday advance loan.

This one gets us irritated up. Since these businesses prey on individuals who can not pay their expenses. Technically, these are short-term loans that offer you your paycheck in breakthrough.

The Ultimate Guide To Personal Loans copyright

Due to the fact that points obtain actual messy real fast when you miss a settlement. Those lenders will come after your wonderful grandma who cosigned the financing for you. Oh, and you must never ever guarantee a lending for anybody else either!

However all you're truly doing is utilizing new financial obligation to settle old financial obligation (and prolonging your funding term). That just suggests you'll be paying a lot more gradually. Business understand that toowhich is exactly why many of them offer you combination finances. A lower rates of interest doesn't get you out of debtyou do.

And it starts with not obtaining any more money. Whether you're assuming of taking out a personal loan to cover that kitchen area remodel or your overwhelming credit card expenses. Taking out financial debt to pay for points isn't the way to go.

The Ultimate Guide To Personal Loans copyright

And if you're considering a personal finance to cover an emergency situation, we obtain it. Obtaining money to pay for an emergency only intensifies the anxiety and difficulty of the scenario.

Report this page